Children’s hospitals in a lot of ways face the same challenges that general acute care hospitals do: inpatient demand declines, the shift to outpatient care, implementing value-based care, addressing the shift to prevention, and catering to future trends in consumerism.

So what is unique about children’s hospitals besides the age and size of the patient? Pediatrics is a much smaller market and therefore often sees fierce competition among not only children’s hospitals but also integrated delivery care networks, where general hospitals have formed pediatric partnerships. In order to stay competitive within the market, strategies must be deployed to protect and strengthen market reach by addressing challenges in the pediatric space.

- The pediatric population requires very specialized care. A neonatal intensive care (NICU) patient and a 16-year old with the same diagnosis require different pediatric subspecialists, which can be difficult to find, especially given the provider shortage the field is experiencing. Additionally, pediatric patients often have to travel much further than adult patients, and care managers have to think about where families can stay affordably if their child will be in the hospital for extended periods of time. Embracing telemedicine while working on recruitment plans can offer some relief.

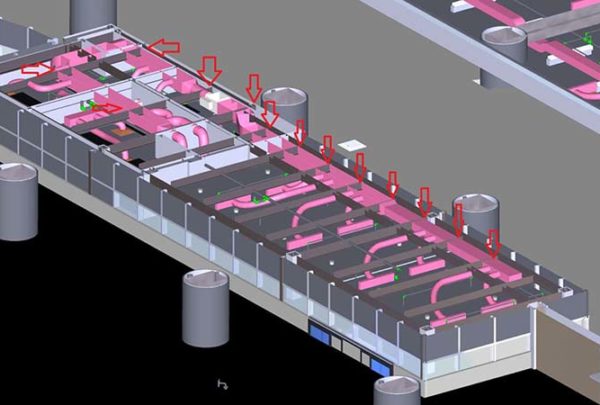

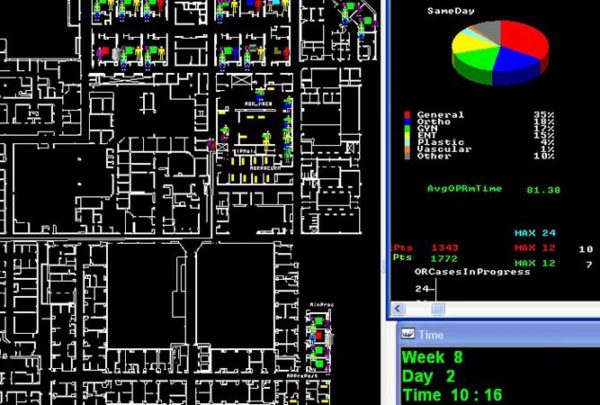

- We typically see a lot of seasonality in pediatric visits compared with the adult population, especially around flu season and the start of a new school year. These large swings in census require a deeper dive into analytics to understand the most appropriate utilization rates for master planning and bed needs. By decreasing utilization targets we can better account for this type of variation.

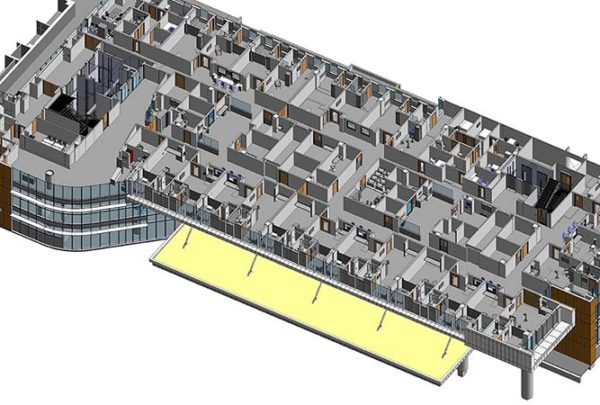

- Lack of easily accessible complementary adult services is another area that may present a challenge. For example, if a mother requires care while her baby is in the NICU, having access to co-located adult services would be preferable to having to be transported and separated from her child. Co-location comes with its own set of challenges, however; if a women’s unit is built, ICU rooms must also be available, which results in a lot of overhead for likely low utilization. Haskell recently worked on a case where the children’s hospital did not provide obstetrics services; consequently, all babies admitted to the NICU have been transferred from another facility. The hospital is now considering the addition of a Maternal Fetal Medicine (MFM) program on the campus, which would allow the larger health system that the hospital is affiliated with the opportunity to direct high-risk mothers to the children’s hospital. This strategy also helps retain patients within the network and improves continuity of care.

- Children’s hospitals are pioneers in family-/patient-centered care as children are highly dependent on their family system in seeking care. However, if families are disengaged or unable to provide the necessary support, it is critical to find alternative ways to make care more convenient and/or pull in additional support from a child’s system of care (school, social workers, etc.). We’re seeing the industry headed toward virtual care more and more as patients and families are seeking convenience. For example, some hospitals are now leveraging telehealth capabilities to do virtual rounding in the NICU as parental work obligations, financial constraints, etc., may make it difficult for a family to fully participate in person. Additionally, the Children’s Hospital of Philadelphia (CHOP) is piloting a school telehealth program where the hospital and school collaborate on diagnoses and helps integrate the child’s network outside of the family.

Like in general acute care hospitals, leveraging technology will be the wave of the future in helping strengthen family-/patient-centered care in children’s hospitals. But staying competitive also involves incorporating the right mix of complementary services and utilizing in-depth analytics to fine-tune bed planning needs, especially as margins continue to be squeezed.