As insurers and patient consumerism drive site-of-care decisions, many orthopedic procedures that historically have been performed in an inpatient setting are shifting to an ambulatory setting.

Hospitals and health systems are therefore faced with a difficult question: Do they transition highly profitable orthopedic procedures to the outpatient setting in pursuit of increased volume and revenue at a lower margin? Or do they keep these services in the inpatient setting to maintain existing margins at the risk of not positioning for the future?

Orthopedic Trends and the Shift toward Ambulatory Surgery

Technology and clinical interventions are enabling the quick procedure and recovery times necessary to make ambulatory surgery centers (ASCs) an attractive option for a broader array of procedures. Additionally, payer coverage of outpatient procedures continues to push volumes out of the hospital setting in pursuit of the triple aim of quality of care, affordability, and access. Despite these advances, though, health systems need to place patient safety at the forefront when deciding to shift targeted procedures from inpatient to outpatient.

Price transparency also influences patients to select the ambulatory environment to cut their out-of-pocket costs. Patient consumerism and shopping have outpaced physician recommendations as 35% of patients “shopped” for their surgeon and site of care,[i] increasing the importance of providing care in the right place at the right time with a top provider.

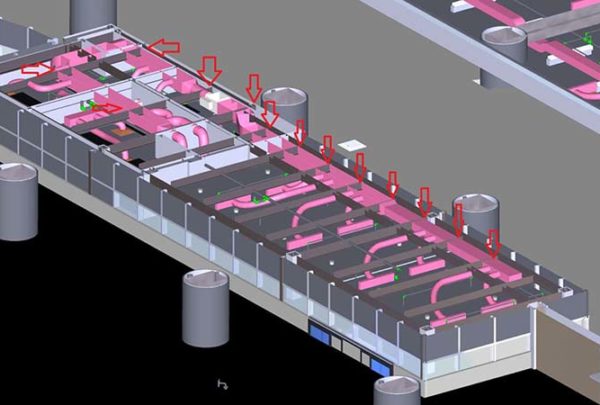

In 2017 the number of outpatient orthopedic procedures outpaced inpatient procedures 16:1.[ii] Inpatient services remain more profitable even as outpatient services drive higher volumes and revenue. The margin potential on the outpatient side is derived through standardization and high utilization of fixed assets. High-volume procedures like hip and knee replacements generate an opportunity for higher revenues with the potential for standardization to improve margins.

Despite patient and provider preference for the ambulatory setting, shifting orthopedic procedures to outpatient can come at a risk to hospitals and hospital systems. Losing hospital outpatient department (HOPD) reimbursement and potentially unfavorable value-based contracts can diminish margins. Also, if efficiencies are not realized on the ambulatory side, high-volume cases will not translate high revenues into favorable margin capture. Another risk factor within orthopedics is a competitive marketplace composed of highly regarded specialty groups and physician-owned ambulatory surgical centers (ASCs), which tend to be highly efficient and effective at a lower price.

Should Your Organization Move Orthopedic Procedures Ambulatory?

Deciding whether to shift orthopedic procedures from your inpatient surgical services to an ambulatory setting is not easy. Many factors need to be considered to make the best decision for your facility and patients.

- Evaluate service/procedure shift opportunity as well as what that would mean for your existing orthopedic platform’s utilization – We’ve worked with hospitals that were interested in pursuing an ASC without the volume and market share to realize efficiencies needed to maintain profitability.

- Shift opportunity to target appropriate services to ambulatory based on:

- Correct site of care/patient safety

- Patient access

- Market capture opportunity

- Reimbursement/financial viability

- Patient and provider acceptability

- If your organization currently owns an HOPD, pursue a strategy to increase or shift procedures where possible within the same care family (stipulations for what can be done here due to the Budget Act of November 1, 2015). Favorable reimbursements in the HOPD setting are shrinking, but so are 340B pharmaceutical pricing benefits. CMS is attempting to shift cases to ASCs where appropriate.

- Complete a gap analysis to determine whether the opportunity is realistic. The opportunity needs to address unmet market demand, and market share can be captured through improved access, experience, and expertise.

- Pursue favorable procedures and operational initiatives to grow both revenues and margin. These include:

- Spine: high per-case revenue with favorable margins

- Joints: high volume and high revenue; these procedures provide an opportunity for high margins through operational standardization and high utilization of fixed assets.

- Pursue an ASC through new build or a joint venture, merger, or acquisition – aligning with a physician-owned ASC through a joint venture or buyout/employment can help you emulate what made that practice successful: efficient operations and incentives for providers (if bought out and employed) to maintain profitability

- Pursue value-based contracts and bundles (i.e., hip and knee) to compete for insured patient volumes

The decision to push orthopedic procedures to the ambulatory environment involves many variables. Evaluating the opportunity shift and looking at procedures, providers, and the patient base can help you find the right fit for your organization and market.