To say that 2020 was difficult for hospitals and health systems would be an understatement. COVID-19 wreaked havoc on healthcare, with revenues, patient volume, and margins falling below 2019 levels. The industry is at a pivotal point of disruption, and change is happening rapidly – almost too rapidly.

The industry will be dealing with the impact of COVID-19 for years to come. Provider burnout is real, and hospitals will have to focus on the well-being of those delivering healthcare as well as their patients. The patient experience is also evolving; patients are approaching healthcare with new expectations and fears, and providers should concentrate on patient education, outcomes, and mental health. Telehealth is here to stay, so health systems will need to simultaneously deploy various operational strategies to support multiple methods of delivering care to patients that will accommodate different environments and reduce costs. The pandemic also exposed vulnerabilities in the supply chain, leading hospitals and health systems to think more about consolidation and centralization while integrating predictive analytics so they’re better prepared for the next event.

To deal with these and other issues, we see four major trends emerging that will affect healthcare design in 2021.

Reducing Overall Costs

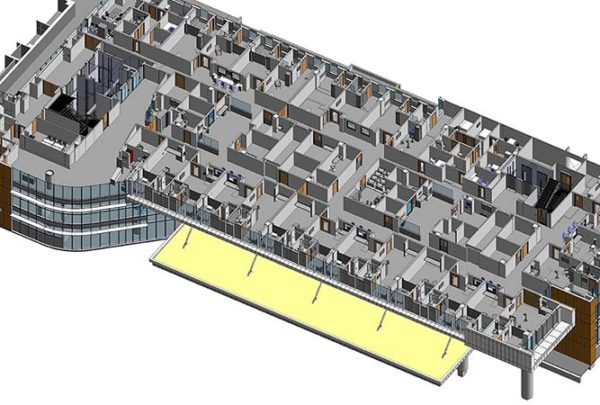

The financial hit experienced in 2020 will place cost reductions at the forefront of everyone’s minds in 2021. For healthcare design this means hospitals and health systems will face mandates that call for affordability and durability. Fixed-cost restructuring will shift from bed reduction to bed flexibility, focusing on administrative and ambulatory functions outside I-2 construction. Similarly, hospitals will look toward the consolidation and renovation of their existing assets, particularly medical office buildings and ambulatory facilities.

Rather than implementing new construction, hospitals will likely undertake smaller, strategic projects that focus on areas that generate significant revenue, like operating rooms and ambulatory surgery centers, and look to fill gaps that exist within the market. Integrating operational changes is another way to reduce costs. Unfortunately, many health systems are trying to take advantage of economies of scale without tackling differing operations. This can cause inefficiencies that are both costly and chaotic. The long-term impact of operational efficiencies on costs is so much greater than short-term capital reductions.

New Definition of Healthcare Design Customer

The customer is no longer only healthcare systems and hospitals; more and more we need to consider independent providers, financial investors, and health plans as users of healthcare design. We can expect to see continued strategic alliances between health systems and independent provider groups, based on not only market consolidation fears but as a way of reducing duplicate services and costs. Additionally, many single providers prefer to align with independent groups but may be acquired by private equity firms or health plans such as Humana, Optum, and Blue Cross Blue Shield to secure patient panels and offset larger capital costs. Either way, these new healthcare clients will expect the design community to sharpen their pencils for cost reduction, be ready to deploy facility prototypes for site adaptation, and promote standardized operational efficiencies/protocols across all services and facility types.

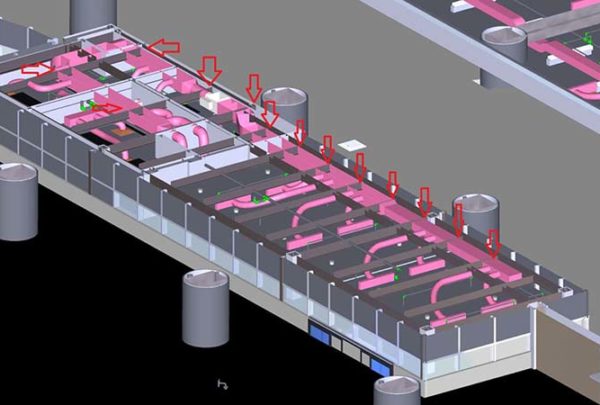

Leveraging Scale – More Centralized Decision-Making, Local Execution

Leveraging scale means more centralized design standards and operational models and the integration of financial and operational outcome metrics. “Value” will be a keyword in 2021, and leveraging scale is a great way to demonstrate consistent outcomes. COVID gave providers the opportunity to leverage and demonstrate the value of scale, and this will likely result in level-loading service distribution across systems and geographical locations.

While COVID caused numerous issues for hospitals and health systems, it did not dampen enthusiasm for M&A activity. In fact, the financial pressures from the pandemic strengthened the need for systems to form new partnerships. That trend will continue into 2021, with systems looking to focus on value by forming new horizontal and vertical partnerships. Forming new partnerships is also a better option for supply chains, which were hit by shortages in 2020, than having larger stockpiles.

All this being said, we expect that the new administration will continue to scrutinize “mega” mergers and acquisitions in their quest to implement cost-control measures.

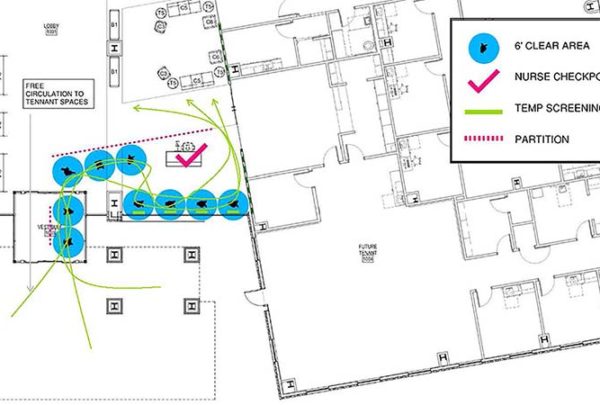

Divergence of Healthcare Design

Capacity shortages and fear led lower-acuity patients out of the emergency room and into telehealth or clinics in 2020, and we do not anticipate their return to pre-2020 levels. This means only the sickest patients will be treated in acute settings, and hospital designs will become more complex to accommodate the technology and operational models needed to treat these patients. There will also be a heightened focus on infection control in all settings, but more so in acute care. In addition, system-based outreach services will likely to be more integrated into acute settings, such as labs and pharmacies, to capitalize on existing technological investments, equipment, and staff, especially as the marketplace becomes more competitive with consumer and independent provider options such as CVS, Walgreens, Walmart, and even Amazon.

In sharp contrast to hospitals, more ambulatory care is likely to be moved into the home setting. Telehealth will continue to increase in an effort to address unaffordability and inequity in healthcare access. Senior care will also move more into the home, but systems should be aware of practice, regulatory, and financial barriers that could make adopting this change a lot slower than others.

The most exciting development may be what we call “the clinic of the future.” These clinics are freestanding buildings (think old strip malls and fast food locations) that offer drive-thru and in-and-out services with minimal contact with other patients and providers. Patients can park outside their exam room and enter once they receive an access code when their room has been prepped and cleaned. These clinics also offer drive-thru access so patients can be tested or receive basic lab services like blood draws or vaccinations without leaving their cars. Look for more information on these newly designed clinics soon.