The health sector has experienced tremendous disruption in the past year, but one healthcare trend had been gaining steam even before the coronavirus pandemic began. Patients who are seeking lower costs and more convenient hours and locations are utilizing retail health clinics more often. Now, the traditional ambulatory environment is facing increased pressures from these retail health clinics and other non-traditional competitors like Amazon and companies in the digital health space. Increasingly, consumers are entrusting their healthcare with non-health sectors and tech-centric consumer companies.

The first retail health clinic opened in 2000, and since then 44% percent of patient visits have occurred when physician offices typically are closed.1 With their on-demand information, extended hours, easily accessible locations, and walk-in appointments, retail health clinics have created convenient, low-cost options for low-acuity conditions while also establishing price transparency. These factors influence how the ambulatory environment should operate and are pushing ambulatory care toward patient-/consumer-centric models.

The scope of services offered at retail clinics has gone beyond the basics. Originally focused on flu shots, sore throats, fevers, infections, and routine health exams, these clinics now offer preventive screenings, chronic disease management (diabetes, asthma, hypertension, cholesterol), infusion services, along with other more complex health offerings. Retail health clinics also have the pharmacist play a more integral role as part of the care team.

Impact of Retail Health

The country’s largest retail chains already offer some health services, but the scope of these services is expanding rapidly. Walmart Health2 currently runs two clinics in Georgia, with plans for more this year. Patients can choose to see the same provider at each visit, helping establish a more traditional patient-doctor relationship. In addition to primary care services, the company also offers lab testing; clinical labs wanting to be a testing provider to Walmart will have to keep costs down to be competitive.

Walgreens will be the first national pharmacy chain to add full-service primary care clinics on a large scale. Walgreens2,4 is partnering with Village MD to create Village Medical at Walgreens, with 500-700 clinics slated to open in the U.S. over the next five years. Clinics will offer 24/7 care through telehealth and at-home visits, and plans to integrate pharmacists as part of a multidisciplinary team, which particularly aids with medication adherence.

On a smaller scale, CVS2 is opening 1,500 Health Hub locations that will expand minute clinic services to include lab testing, telehealth, sleep equipment, and wellness programs. Its competitor, Rite Aid3, will offer virtual care rooms and alternative medicine products like essential oils. Rite Aid differs from other retail pharmacies in that it does not want to own any primary care clinics; it wants to be a connector to providers and care teams rather than compete with them. Like Walgreens, Rite Aid will integrate the pharmacist into the care team, reminding customers to take their medications, discussing alternative remedies to complement traditional ones, and using virtual care to connect people back to care teams.

Impact of Other Non-Traditional Competitors

The expansion into retail health stretches far beyond conventional retailers and pharmacies. Companies are leveraging Big Data analytics, artificial intelligence, and consumer expertise to change the way traditional ambulatory settings treat a patient. This shift will meet people where they are, incorporating on-demand services into care.

Amazon7 has an employee model called Amazon Care, a virtual health program offering telehealth and in-person follow-up care to a subset of its Seattle employees. Working with Crossover Health, they plan to open clinics near their fulfillment centers to provide more convenient, accessible access to employees. In addition, Amazon is leveraging its internet expertise to provide telehealth. They say the combination of telehealth with the data collection and analysis from wearables and remote monitoring “could be the biggest healthcare change of our lifetime.”

But Amazon isn’t the only tech company moving into healthcare. Mobile apps are offering real-time video chats for on-demand healthcare services. An app, Heal5, not only provides telehealth on demand but also house calls (8 am – 8 pm, seven days a week), which allows the doctor to see the patient’s life in their home.

Another development that will continue to grow and influence ambulatory care is the digital therapeutic. A digital therapeutic6 is software-driven, backed by evidence, and able to prevent and manage a disease or a disorder. For example, BlueStar by WellDoc targets type I and II diabetes and aids in diabetes self-management. Through this service, patients receive one of 30,000+ automated, tailored, and unique coaching messages to encourage them to take in real-time actions – including daily medication administration, physical activity, smart food choices, and psychosocial wellbeing.

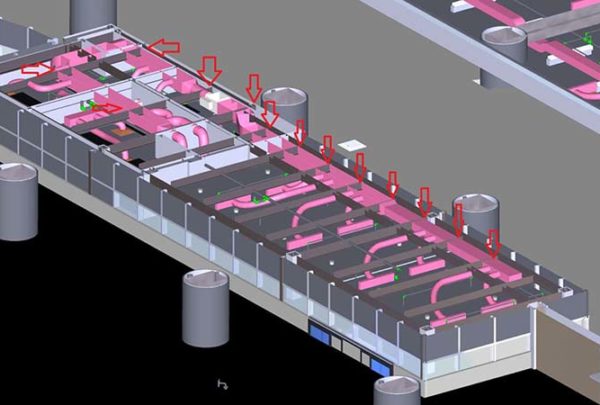

The ambulatory environment is redefining itself in response to these disruptors. Its solutions need to be retail-oriented and consumer-focused to address evolving patient expectations. With the many unoccupied freestanding and strip mall restaurant and retail spaces available, health systems have the opportunity to repurpose these empty spaces into clinics in areas that already have ample parking and easy access in high-traffic areas. Design spaces will need to be convenient and tailored to specific needs with an inviting environment and a mix of virtual/physical care.

To better compete with these non-traditional healthcare players, health systems must reevaluate their approach now to meet their patients where they live. More convenient locations and operating hours, as well as better integration of on-demand care, will be the future.

https://www.gensler.com/research-insight/blog/retail-health-retail-medicine-the-new-healthcare-experience

https://www.darkdaily.com/walmart-health-opens-two-primary-care-clinics-at-retail-supercenters-in-chicago-with-plans-to-open-seven-florida-locations-in-2021/

https://www.advisory.com/Daily-Briefing/2020/10/20/rite-aid

https://www.advisory.com/Daily-Briefing/2020/07/10/walgreens

https://www.consumerreports.org/healthcare/alternatives-to-traditional-medical-care/

https://dtxalliance.org/productbluestar

https://www.managedhealthcareexecutive.com/view/amazon-s-quiet-selective-forays-into-healthcare