The world of venture capital and startups might seem more about revolution than evolution. Still, the recent bankruptcy declaration by Katerra, a designer, contractor and supplier focused on modular construction, is a warning to industry startups that would grow too big too fast.

The company’s vision statement said, in part, that “Incremental progress isn’t enough — we are pursuing transformational change on a massive scale,” and tremendous levels of venture funding allowed that pursuit to occur without constraint.

But, ultimately, massive scale without a proper foundation doomed Katerra and dealt significant blows to its principal stakeholders, said Cutler Knupp, Director of Strategy and Technology Investments for Dysruptek, a Haskell Company.

“Katerra is a great case study for the difficulties of venture capital in the construction industry,” Knupp said. “You really hate to see it collapse the way it did. Startups like Katerra should succeed or fail based on merit, not on reckless financial engineering. It’s unfortunate, but Katerra’s failure does not signal doom for the rest of the modular construction business.”

Katerra’s original mission was to use modular construction to solve affordable housing shortages plaguing large U.S. cities. What set it apart from its competitors was its unrivaled level of funding. SoftBank’s Vision Fund poured more than $2 billion into Katerra.

As capital flowed in, Katerra became overextended through aggressive office expansions and acquisitions. One of its creditors. Greensill Capital forgave $435 million in Katerra debt in exchange for a 5% stake in the company. But when Greensill, another Softbank-funded startup, collapsed in March 2021, SoftBank pulled the plug on both.

“Katerra’s enormous pool of funding likely hindered its core development,” Knupp said. “Large sources of funding caused it to become too aggressive and bite off more than it could chew. The company became enamored with flashy expansions and acquisitions instead of focusing on developing its core business model.

“The key takeaway from Katerra’s collapse is that construction is challenging, and our industry has unique hurtles startups need to address in a specialized manner before undergoing new ventures or tackling too much too quickly.”

Through Dysruptek, Haskell identified and made a strategic investment in BLOX, a pioneer in delivering modular solutions to health care providers across the country. BLOX has modular design, prefabrication, installation and construction capabilities for projects ranging from standard operating and exam rooms to large-scale ambulatory and acute care facilities.

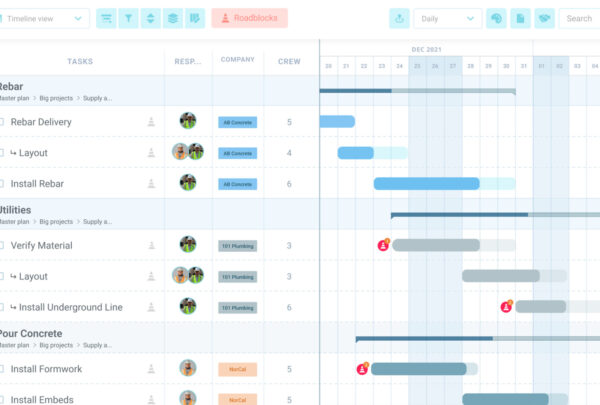

Modular construction and Design, Manufacture, Construct (DMC) project delivery are gradually gaining in popularity and market share in the US market. Construction is a static and change-averse industry, and practices change slowly even in the face of eye-popping amounts of venture capital.

“Execution is the difference maker,” Knupp said. “Anyone can have a vision, but to succeed in construction, that vision needs to be smartly executed through efficiency and planning. Relentless solution iterations and focus on measured growth is critical for construction startups. Nascent construction firms should first focus on developing and improving their core offering servicing a relevant pain point before attempting to expand into new areas.”

For that very reason, industry experts looked askance upon Katerra long before it sought the protection of Chapter 11.

“Katerra was truly an outlier among modular and prefabricated construction firms,” Knupp said. “Investment research in the industry would actually exclude data from Katerra from time to time because their largesse significantly skewed market research and valuations.”

Smaller, more focused firms, such as BLOX, are making breakthroughs in construction technology. From a cost and efficiency standpoint, prefabricated and modular construction are part of the future of the construction industry, and Katerra’s failure belies its promise.

“Most players in the modular construction business were certainly rooting for Katerra’s success, as Katerra’s growth would bring up the whole industry,” Knupp said. “Looking on the bright side, however, Katerra’s downfall will bring a surplus of modular construction experts to the market looking for new jobs, benefitting smaller firms looking to fill the void Katerra’s collapse left behind.”